2 Jul.2020

"At its worst, the price of charter flights tripled and freight rates increased five times, but air capacity was still not available. ” This is the voice of a cross-border logistics practitioner facing the global coronavirus epidemic. The shortage of air cargo capacity and the large number of shipping shutdowns have brought great challenges to the cross-border logistics industry, which plays an important role in international trade.

Insufficient aircraft availability with a sharp capacity shortage

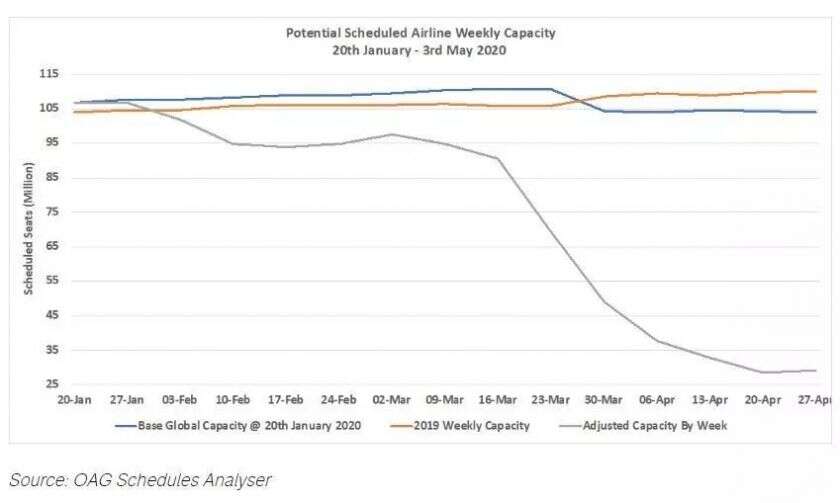

A mismatch between air cargo supply and demand has caused freight rates to rise recently. This has been driven by falls in capacity outpacing drops in demand, largely because passenger aircraft with significant bellyhold capacity have been grounded amid swingeing restrictions on air travel.

Scheduled airline capacity by week compared to schedules filed on 20th January 2020

As the CEO Assistant and General Manager of the US Region of ECMS Express Co., Ltd. said that with the rapid spread of coronavirus worldwide, some foreign trade factories have been suspended and orders have been reduced. However, due to the surge in demand for epidemic prevention materials at home and abroad, many overseas countries have suspended international flights, and airlines are faced with the situation of "Insufficient aircraft availability".

Since the outbreak of Covid-19, the company's business has also fluctuated. As a global cross-border logistics company, e-commerce has experienced the first half of the domestic epidemic from February to March, and ushered in the second half of the international epidemic relay from March to April.

"Then the reverse will begin, and domestic shipments of materials from overseas will be carried out in large quantities." The huge demand for materials has brought challenges to cross-border logistics companies, and transportation costs have also risen and even doubled case.

Of course, not just the cost, but also the time. All domestic cross-border logistics companies faced the problems of rising logistics costs at the same time, falling logistics efficiency, and prolonged transportation cycles. "The biggest challenge is well funded but no air capacity." She said.

In the latest data for the freight sector, IATA states that global cargo demand measured in freight tonne kilometers was down 15% in March year-on-year, while capacity saw a steeper drop of 23%.

Shipping companies raise prices, but no shipping space available

However, according to the latest data provided by Alphaliner, as of May 11, the number of global ocean carriers idle container ships reached 524, with a total idle capacity of 2.65 million TEU. This data broke the previous record of 2.46 million TEUs set by the global coronavirus pandemic in early March and became the latest historical record.

Due to the impact of coronavirus, global trade has shrunk and the overall volume of goods has dropped. Many shipping routes have been forced to stop. In order to grab the only remaining volume in the market, they can only compete with their peers at low prices, but the cost pressure is also increasing.

Now many shipping companies have raised prices. It is reported that Maersk, CMA and Hapag-Lloyd have announced the levy of new surcharges or increased freight rates. For example, Hapag-Lloyd announced that from June 1, 2020, the increase from Northern Europe to the Far East (excluding Japan) for all 20-foot and 40-foot containers (including high cube) of marine cargo tax rates until further notice.

On the other hand, due to the shortage of shipping routes, the shipping space is tight, and the situation of container dumping is very serious. Statistics show that from May to June, shipping companies suspended 167 voyages in Asia-North America/Europe. As of the end of May, the South China market exceeded 12,000 TEU and the Central China market exceeded 15,000 TEU. According to the published shipping schedule information, there are still a large number of closed routes in June, then the tight space and container dumping might become the norm.

This year or more years will be an extreme challenge for the global cross-border logistics industry, it also impacts on global foreign trade. There is very little management “wiggle” room anymore, and no time for trial and error. It is clear that, in an environment with tight air cargo and shipping space,developing business steadily on the basis of maintaining basic operations has become the choice of more sellers.